Dr. Wade Adams is the Director of the Smalley Institute for Nanoscale Science and Technology at Rice University. The Institute is devoted to the development of new innovations on the nanometer scale. Some of the institute's current thrusts include research in carbon nanotubes, medical applications of nanoparticles, nanoporous membranes, molecular computing, and nanoshell diagnostic and therapeutic applications.

Wade was appointed a senior scientist (ST) in the Materials Directorate of the Wright Laboratory in 1995. Prior to that he was a research leader and in-house research scientist in the directorate. For the past 36 years he has conducted research in polymer physics, concentrating on structure-property relations in high-performance organic materials. He is internationally known for his research in high-performance rigid-rod polymer fibers, X-ray scattering studies of fibers and liquid crystalline films, polymer dispersed liquid crystals, and theoretical studies of ultimate polymer properties.

TEDxHouston 2011 - Wade Adams - Nanotechnology and Energy

Monday, October 31, 2011

Sunday, October 30, 2011

Ron Paul Interview with Nashua Telegraph Editorial Board

Ron Paul hour long panel interview with the Nashua Telegraph Editorial Board on October 28, 2011.

Ron Paul hour long interview 10/28/11

Ron Paul hour long interview 10/28/11

Saturday, October 29, 2011

The Zeitgeist Movement | LA, CA - TownHall Oct 26

The Zeitgeist Movement | LA, CA - TownHall - Part 1 - Intro]

Jason Lord | "Visualizing a Systems Approach" | The Zeitgeist Movement | [LA TownHall - Part 2]

Peter Joseph | "From Consequences to Solutions"| The Zeitgeist Movement | [LA TownHall - Part 3]

Jason Lord | "Visualizing a Systems Approach" | The Zeitgeist Movement | [LA TownHall - Part 2]

Peter Joseph | "From Consequences to Solutions"| The Zeitgeist Movement | [LA TownHall - Part 3]

Friday, October 28, 2011

Peter Joseph on Media & Occupy Wall Street | RT Oct 27 [The Zeitgeist Movement]

Peter Joseph on Media & Occupy Wall Street | 'Russia Today' Oct 27, 2011 [The Zeitgeist Movement]

Thursday, October 27, 2011

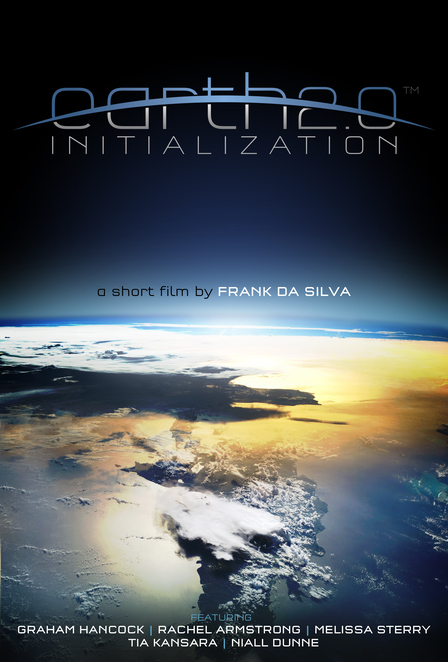

EARTH 2.0: Initialization

EARTH 2.0™ is an exciting and ambitious collaboration of innovative and far sighted developments in science and technology combined with the visualisation, imagery and stimulus achieved through the medium of film and interactive technologies to alter thinking and create a movement for change to deliver the sustainable world of the future.

Earth 2.0's premise is that it is the interchange of ideas through engagement, participation and interaction that will change peoples' minds, and motivate and inspire individuals and communities to deliver the change that is required for us to create a global and sustainable future for the earth and therefore humanity.

Earth 2.0: Initialization series of short films marks the beginning of this ambitious undertaking and also serves to convey the innovative look and feel of Earth 2.0's media output aiming to re-establish a harmonious relationship between humanity and nature, using art, science and digital creativity.

EARTH 2.0 INITIALIZATION - director's cut

EU 2ND BAILOUT - Euro Region Leaders’ Joint Statement on Resolving Debt Crisis

The following is a reformatted version of a joint statement released by leaders of the euro region following a summit today in Brussels.

1. Over the last three years, we have taken unprecedented steps to combat the effects of the world-wide financial crisis, both in the European Union as such and within the euro area. The strategy we have put into place encompasses determined efforts to ensure fiscal consolidation, support to countries in difficulty, and a strengthening of euro area governance leading to deeper economic integration among us and an ambitious agenda for growth. At our 21 July meeting we took a set of major decisions. The ratification by all 17 Member States of the euro area of the measures related to the EFSF significantly strengthens our capacity to react to the crisis. Agreement by all three institutions on a strong legislative package within the EU structures on better economic governance represents another major achievement. The introduction of the European Semester has fundamentally changed the way our fiscal and economic policies are co-ordinated at European level, with co- ordination at EU level now taking place before national decisions are taken. The euro continues to rest on solid fundamentals.

2. Further action is needed to restore confidence. That is why today we agree on a comprehensive set of additional measures reflecting our strong determination to do whatever is required to overcome the present difficulties and take the necessary steps for the completion of our economic and monetary union. We fully support the ECB in its action to maintain price stability in the euro area. Sustainable public finances and structural reforms for growth

3. The European Union must improve its growth and employment outlook, as outlined in the growth agenda agreed by the European Council on 23 October 2011. We reiterate our full commitment to implement the country specific recommendations made under the first European Semester and on focusing public spending on growth areas.

4. All Member States of the euro area are fully determined to continue their policy of fiscal consolidation and structural reforms. A particular effort will be required of those Member States who are experiencing tensions in sovereign debt markets.

5. We welcome the important steps taken by Spain to reduce its budget deficit, restructure its banking sector and reform product and labour markets, as well as the adoption of a constitutional balanced budget amendment. Strictly implementing budgetary adjustment as planned is key, including at regional level, to fulfil the commitments of the stability and growth Pact and the strengthening of the fiscal framework by developing lower level legislation to make the constitutional amendment fully operative. Further action is needed to increase growth so as to reduce the unacceptable high level of unemployment. Actions should include enhancing labour market changes to increase flexibility at firm level and employability of the labour force and other reforms to improve competitiveness, specially extending the reforms in the service sector.

6. We welcome Italy’s plans for growth enhancing structural reforms and the fiscal consolidation strategy, as set out in the letter sent to the Presidents of the European Council and the Commission and call on Italy to present as a matter of urgency an ambitious timetable for these reforms. We commend Italy’s commitment to achieve a balanced budget by 2013 and a structural budget surplus in 2014, bringing about a reduction in gross government debt to 113% of GDP in 2014, as well as the foreseen introduction of a balanced budget rule in the constitution by mid 2012. Italy will now implement the proposed structural reforms to increase competitiveness by cutting red tape, abolishing minimum tariffs in professional services and further liberalising local public services and utilities. We note Italy’s commitment to reform labour legislation and in particular the dismissal rules and procedures and to review the currently fragmented unemployment benefit system by the end of 2011, taking into account the budgetary constraints. We take note of the plan to increase the retirement age to 67 years by 2026 and recommend the definition by the end of the year of the process to achieve this objective.

We support Italy’s intention to review structural funds programs by reprioritising projects and focussing on education, employment, digital agenda and railways/networks with the aim of improving the conditions to enhance growth and tackle the regional divide. We invite the Commission to provide a detailed assessment of the measures and to monitor their implementation, and the Italian authorities to provide in a timely way all the information necessary for such an assessment. Countries under adjustment programme

7. We reiterate our determination to continue providing support to all countries under programmes until they have regained market access, provided they fully implement those programmes.

8. Concerning the programme countries, we are pleased with the progress made by Ireland in the full implementation of its adjustment programme which is delivering positive results. Portugal is also making good progress with its programme and is determined to continue undertaking measures to underpin fiscal sustainability and improve competitiveness. We invite both countries to keep up their efforts, to stick to the agreed targets and stand ready to take any additional measure required to reach those targets.

9. We welcome the decision by the Eurogroup on the disbursement of the 6th tranche of the EUIMF support programme for Greece. We look forward to the conclusion of a sustainable and credible new EU-IMF multiannual programme by the end of the year.

10. The mechanisms for the monitoring of implementation of the Greek programme must be strengthened, as requested by the Greek government. The ownership of the programme is Greek and its implementation is the responsibility of the Greek authorities. In the context of the new programme, the Commission, in cooperation with the other Troika partners, will establish for the duration of the programme a monitoring capacity on the ground, including with the involvement of national experts, to work in close and continuous cooperation with the Greek government and the Troika to advise and offer assistance in order to ensure the timely and full implementation of the reforms. It will assist the Troika in assessing the conformity of measures which will be taken by the Greek government within the commitments of the programme. This new role will be laid down in the Memorandum of Understanding. To facilitate the efficient use of the sizeable official loans for the recapitalization of Greek banks, the governance of the Hellenic Financial Stability Fund (HFSF) will be strengthened in agreement with the Greek government and the Troika.

11. We fully support the Task Force on technical assistance set up by the Commission.

12. The Private Sector Involvement (PSI) has a vital role in establishing the sustainability of the Greek debt. Therefore we welcome the current discussion between Greece and its private investors to find a solution for a deeper PSI. Together with an ambitious reform programme for the Greek economy, the PSI should secure the decline of the Greek debt to GDP ratio with an objective of reaching 120% by 2020. To this end we invite Greece, private investors and all parties concerned to develop a voluntary bond exchange with a nominal discount of 50% on notional Greek debt held by private investors. The Euro zone Member States would contribute to the PSI package up to 30 bn euro. On that basis, the official sector stands ready to provide additional programme financing of up to 100 bn euro until 2014, including the required recapitalisation of Greek banks. The new programme should be agreed by the end of 2011 and the exchange of bonds should be implemented at the beginning of 2012. We call on the IMF to continue to contribute to the financing of the new Greek programme.

13. Greece commits future cash flows from project Helios or other privatisation revenue in excess of those already included in the adjustment programme to further reduce indebtedness of the Hellenic Republic by up to 15 billion euros with the aim of restoring the lending capacity of the EFSF.

14. Credit enhancement will be provided to underpin the quality of collateral so as to allow its continued use for access to Eurosystem liquidity operations by Greek banks.

15. As far as our general approach to private sector involvement in the euro area is concerned, we reiterate our decision taken on 21 July 2011 that Greece requires an exceptional and unique solution.

Full Text Here - Bloomberg - Euro Region Leaders’ Joint Statement on Resolving Debt Crisis

Read also:Bloomberg - EU Sets 50% Greek Writedown, $1.4T in Rescue Fund

1. Over the last three years, we have taken unprecedented steps to combat the effects of the world-wide financial crisis, both in the European Union as such and within the euro area. The strategy we have put into place encompasses determined efforts to ensure fiscal consolidation, support to countries in difficulty, and a strengthening of euro area governance leading to deeper economic integration among us and an ambitious agenda for growth. At our 21 July meeting we took a set of major decisions. The ratification by all 17 Member States of the euro area of the measures related to the EFSF significantly strengthens our capacity to react to the crisis. Agreement by all three institutions on a strong legislative package within the EU structures on better economic governance represents another major achievement. The introduction of the European Semester has fundamentally changed the way our fiscal and economic policies are co-ordinated at European level, with co- ordination at EU level now taking place before national decisions are taken. The euro continues to rest on solid fundamentals.

2. Further action is needed to restore confidence. That is why today we agree on a comprehensive set of additional measures reflecting our strong determination to do whatever is required to overcome the present difficulties and take the necessary steps for the completion of our economic and monetary union. We fully support the ECB in its action to maintain price stability in the euro area. Sustainable public finances and structural reforms for growth

3. The European Union must improve its growth and employment outlook, as outlined in the growth agenda agreed by the European Council on 23 October 2011. We reiterate our full commitment to implement the country specific recommendations made under the first European Semester and on focusing public spending on growth areas.

4. All Member States of the euro area are fully determined to continue their policy of fiscal consolidation and structural reforms. A particular effort will be required of those Member States who are experiencing tensions in sovereign debt markets.

5. We welcome the important steps taken by Spain to reduce its budget deficit, restructure its banking sector and reform product and labour markets, as well as the adoption of a constitutional balanced budget amendment. Strictly implementing budgetary adjustment as planned is key, including at regional level, to fulfil the commitments of the stability and growth Pact and the strengthening of the fiscal framework by developing lower level legislation to make the constitutional amendment fully operative. Further action is needed to increase growth so as to reduce the unacceptable high level of unemployment. Actions should include enhancing labour market changes to increase flexibility at firm level and employability of the labour force and other reforms to improve competitiveness, specially extending the reforms in the service sector.

6. We welcome Italy’s plans for growth enhancing structural reforms and the fiscal consolidation strategy, as set out in the letter sent to the Presidents of the European Council and the Commission and call on Italy to present as a matter of urgency an ambitious timetable for these reforms. We commend Italy’s commitment to achieve a balanced budget by 2013 and a structural budget surplus in 2014, bringing about a reduction in gross government debt to 113% of GDP in 2014, as well as the foreseen introduction of a balanced budget rule in the constitution by mid 2012. Italy will now implement the proposed structural reforms to increase competitiveness by cutting red tape, abolishing minimum tariffs in professional services and further liberalising local public services and utilities. We note Italy’s commitment to reform labour legislation and in particular the dismissal rules and procedures and to review the currently fragmented unemployment benefit system by the end of 2011, taking into account the budgetary constraints. We take note of the plan to increase the retirement age to 67 years by 2026 and recommend the definition by the end of the year of the process to achieve this objective.

We support Italy’s intention to review structural funds programs by reprioritising projects and focussing on education, employment, digital agenda and railways/networks with the aim of improving the conditions to enhance growth and tackle the regional divide. We invite the Commission to provide a detailed assessment of the measures and to monitor their implementation, and the Italian authorities to provide in a timely way all the information necessary for such an assessment. Countries under adjustment programme

7. We reiterate our determination to continue providing support to all countries under programmes until they have regained market access, provided they fully implement those programmes.

8. Concerning the programme countries, we are pleased with the progress made by Ireland in the full implementation of its adjustment programme which is delivering positive results. Portugal is also making good progress with its programme and is determined to continue undertaking measures to underpin fiscal sustainability and improve competitiveness. We invite both countries to keep up their efforts, to stick to the agreed targets and stand ready to take any additional measure required to reach those targets.

9. We welcome the decision by the Eurogroup on the disbursement of the 6th tranche of the EUIMF support programme for Greece. We look forward to the conclusion of a sustainable and credible new EU-IMF multiannual programme by the end of the year.

10. The mechanisms for the monitoring of implementation of the Greek programme must be strengthened, as requested by the Greek government. The ownership of the programme is Greek and its implementation is the responsibility of the Greek authorities. In the context of the new programme, the Commission, in cooperation with the other Troika partners, will establish for the duration of the programme a monitoring capacity on the ground, including with the involvement of national experts, to work in close and continuous cooperation with the Greek government and the Troika to advise and offer assistance in order to ensure the timely and full implementation of the reforms. It will assist the Troika in assessing the conformity of measures which will be taken by the Greek government within the commitments of the programme. This new role will be laid down in the Memorandum of Understanding. To facilitate the efficient use of the sizeable official loans for the recapitalization of Greek banks, the governance of the Hellenic Financial Stability Fund (HFSF) will be strengthened in agreement with the Greek government and the Troika.

11. We fully support the Task Force on technical assistance set up by the Commission.

12. The Private Sector Involvement (PSI) has a vital role in establishing the sustainability of the Greek debt. Therefore we welcome the current discussion between Greece and its private investors to find a solution for a deeper PSI. Together with an ambitious reform programme for the Greek economy, the PSI should secure the decline of the Greek debt to GDP ratio with an objective of reaching 120% by 2020. To this end we invite Greece, private investors and all parties concerned to develop a voluntary bond exchange with a nominal discount of 50% on notional Greek debt held by private investors. The Euro zone Member States would contribute to the PSI package up to 30 bn euro. On that basis, the official sector stands ready to provide additional programme financing of up to 100 bn euro until 2014, including the required recapitalisation of Greek banks. The new programme should be agreed by the end of 2011 and the exchange of bonds should be implemented at the beginning of 2012. We call on the IMF to continue to contribute to the financing of the new Greek programme.

13. Greece commits future cash flows from project Helios or other privatisation revenue in excess of those already included in the adjustment programme to further reduce indebtedness of the Hellenic Republic by up to 15 billion euros with the aim of restoring the lending capacity of the EFSF.

14. Credit enhancement will be provided to underpin the quality of collateral so as to allow its continued use for access to Eurosystem liquidity operations by Greek banks.

15. As far as our general approach to private sector involvement in the euro area is concerned, we reiterate our decision taken on 21 July 2011 that Greece requires an exceptional and unique solution.

Full Text Here - Bloomberg - Euro Region Leaders’ Joint Statement on Resolving Debt Crisis

Read also:Bloomberg - EU Sets 50% Greek Writedown, $1.4T in Rescue Fund

US REVOLT - Police Brutality at Occupy Oakland

Yesterday, the United States and the world witnessed yet another gross violation of the basic human right to popular assembly and peaceful protest. A 24-year old Iraq veteran Scott Olsen, a protester in the peaceful Occupy Oakland demonstration, was shot in the head during an extremely violent police crackdown on the movement. He remains in critical condition with a fractured skull and brain swelling.

Scott is a former marine and a member of Veterans for Peace. He served 2 tours in Iraq (although he opposed the war) and came home safe. Then, in Oakland, he was struck in the head by a rubber bullet or other “non-lethal” projectile while exercising his patriotic duty to demand a government that is accountable to its people. When others tried to help him as he lay unconscious on the ground, they too were deliberately shot with rubber bullets and flash bang grenades.

The crackdown on Occupy Oakland and the shooting of Scott Olsen is rapidly becoming a symbol for the indiscriminate attacks on unarmed civilians and the violent police repression of our global protest movement. From Athens to New York, from Barcelona to Boston and from Cairo to Oakland, a pattern is revealing itself that shows authorities desperately clinging to power through the exercise of brute force and wanton criminality. This cannot stand.

Continue reading - The world is watching: we are all Scott Olsen!

Tear gas! Thrown at Occupy Oakland!

Occupy Wall Street Oakland Protesters Police Engage Tear Gas

Veteran shot in the face by police projectile at Occupy Oakland protests

Oakland Policeman Throws Flash Grenade Into Crowd Trying To Help Injured Protester

Oakland Police Beat a Woman at Occupy Oakland Raid 10-25-11

Royal Society journal archive made permanently free to access

The Royal Society has today announced that its world-famous historical journal archive – which includes the first ever peer-reviewed scientific journal – has been made permanently free to access online.

Around 60,000 historical scientific papers are accessible via a fully searchable online archive, with papers published more than 70 years ago now becoming freely available.

The Royal Society is the world’s oldest scientific publisher, with the first edition of Philosophical Transactions of the Royal Society appearing in 1665. Henry Oldenburg – Secretary of the Royal Society and first Editor of the publication – ensured that it was “licensed by the council of the society, being first reviewed by some of the members of the same”, thus making it the first ever peer-reviewed journal.

Philosophical Transactions had to overcome early setbacks including plague, the Great Fire of London and even the imprisonment of Oldenburg, but against the odds the publication survived to the present day. Its foundation would eventually be recognised as one of the most pivotal moments of the scientific revolution.

Professor Uta Frith FRS, Chair of the Royal Society library committee, said: “I’m delighted that the Royal Society is continuing to increase access to its wonderful resources by opening up its publishing archives. The release of these papers opens a fascinating window on the history of scientific progress over the last few centuries and will be of interest to anybody who wants to understand how science has evolved since the days of the Royal Society’s foundation.”

Treasures in the archive include Isaac Newton’s first published scientific paper, geological work by a young Charles Darwin, and Benjamin Franklin’s celebrated account of his electrical kite experiment. And nestling amongst these illustrious papers, readers willing to delve a little deeper into the archive may find some undiscovered gems from the dawn of the scientific revolution – including accounts of monstrous calves, grisly tales of students being struck by lightning, and early experiments on to how to cool drinks “without the Help of Snow, Ice, Haile, Wind or Niter, and That at Any Time of the Year.”

Henry Oldenburg writes in his introduction to the first edition: “...it is therefore thought fit to employ the Press, as the most proper way to gratify those, whose...delight in the advancement of Learning and profitable Discoveries, doth entitle them to the knowledge of what this Kingdom, or other parts of the World, do, from time to time, afford...”, going on to state that potential contributors are: “...invited and encouraged to search, try, and find out new things, impart their knowledge to one another, and contribute what they can to the Grand design of improving natural knowledge, and perfecting all Philosophical Arts, and Sciences.”

Thomas Huxley FRS wrote in 1870: “If all the books in the world, except the Philosophical Transactions, were to be destroyed, it is safe to say that the foundations of physical science would remain unshaken, and that the vast intellectual progress of the last two centuries would be largely, though incompletely, recorded.”

The move is being made as part of the Royal Society’s ongoing commitment to open access in scientific publishing. Opening of the archive is being timed to coincide with Open Access Week, and also comes soon after the Royal Society announced its first ever fully open access journal, Open Biology.

Search the journal archive here.

Source: Royal Society journal archive made permanently free to access

Download: Philosophical Transactions of the Royal Society | PRE1923

Around 60,000 historical scientific papers are accessible via a fully searchable online archive, with papers published more than 70 years ago now becoming freely available.

The Royal Society is the world’s oldest scientific publisher, with the first edition of Philosophical Transactions of the Royal Society appearing in 1665. Henry Oldenburg – Secretary of the Royal Society and first Editor of the publication – ensured that it was “licensed by the council of the society, being first reviewed by some of the members of the same”, thus making it the first ever peer-reviewed journal.

Philosophical Transactions had to overcome early setbacks including plague, the Great Fire of London and even the imprisonment of Oldenburg, but against the odds the publication survived to the present day. Its foundation would eventually be recognised as one of the most pivotal moments of the scientific revolution.

Professor Uta Frith FRS, Chair of the Royal Society library committee, said: “I’m delighted that the Royal Society is continuing to increase access to its wonderful resources by opening up its publishing archives. The release of these papers opens a fascinating window on the history of scientific progress over the last few centuries and will be of interest to anybody who wants to understand how science has evolved since the days of the Royal Society’s foundation.”

Treasures in the archive include Isaac Newton’s first published scientific paper, geological work by a young Charles Darwin, and Benjamin Franklin’s celebrated account of his electrical kite experiment. And nestling amongst these illustrious papers, readers willing to delve a little deeper into the archive may find some undiscovered gems from the dawn of the scientific revolution – including accounts of monstrous calves, grisly tales of students being struck by lightning, and early experiments on to how to cool drinks “without the Help of Snow, Ice, Haile, Wind or Niter, and That at Any Time of the Year.”

Henry Oldenburg writes in his introduction to the first edition: “...it is therefore thought fit to employ the Press, as the most proper way to gratify those, whose...delight in the advancement of Learning and profitable Discoveries, doth entitle them to the knowledge of what this Kingdom, or other parts of the World, do, from time to time, afford...”, going on to state that potential contributors are: “...invited and encouraged to search, try, and find out new things, impart their knowledge to one another, and contribute what they can to the Grand design of improving natural knowledge, and perfecting all Philosophical Arts, and Sciences.”

Thomas Huxley FRS wrote in 1870: “If all the books in the world, except the Philosophical Transactions, were to be destroyed, it is safe to say that the foundations of physical science would remain unshaken, and that the vast intellectual progress of the last two centuries would be largely, though incompletely, recorded.”

The move is being made as part of the Royal Society’s ongoing commitment to open access in scientific publishing. Opening of the archive is being timed to coincide with Open Access Week, and also comes soon after the Royal Society announced its first ever fully open access journal, Open Biology.

Search the journal archive here.

Source: Royal Society journal archive made permanently free to access

Download: Philosophical Transactions of the Royal Society | PRE1923

Tuesday, October 25, 2011

Richard Wilkinson: How economic inequality harms societies

We feel instinctively that societies with huge income gaps are somehow going wrong. Richard Wilkinson charts the hard data on economic inequality, and shows what gets worse when rich and poor are too far apart: real effects on health, lifespan, even such basic values as trust.

Richard Wilkinson: How economic inequality harms societies

Richard Wilkinson: How economic inequality harms societies

ECB: Tomorrow and the day after tomorrow: A Vision for Europe

Tomorrow and the day after tomorrow: a vision for Europe

Speech by Jean-Claude Trichet, President of the ECB,

at the Humboldt University,

Berlin, 24 October 2011

Ladies and gentlemen,

It is a great pleasure to be invited to speak here at the Humboldt University this evening. One can only be honoured to be in the university of Hegel, Heinrich Heine and the Nobel prize-winning physicists Albert Einstein and Max Planck – not to mention 27 other laureates. But it is with the ideas of the university’s founder – Wilhelm von Humboldt – that I would like to begin my remarks.

As a Frenchman who has lived in Germany for the past eight years, I note with interest that the mother of the university’s founder – Marie-Elisabeth Colomb – came from a French Huguenot family who also made that eastwards move. Her family had emigrated to Berlin following the Revocation of the Edict of Nantes, a reminder that European integration is a process that has been with us for centuries.

Wilhelm von Humboldt himself was deeply engaged with the question of how to create the conditions for individuals to flourish within a society. His answer involved removing the conditions for mutual harm.

In some ways, this speaks to the challenges of European integration.

The individual Member States of the European Union (EU) also seek to flourish. Their actions are interdependent and can both benefit and damage each other. Removing the potential for mutual harm is essential for collective prosperity.

This dialectic between the individual and the community is at the core of the European project. It is the dialectic between the individual nation states and the community of nations. And it presents some of Europe’s most fundamental challenges.

I would like to reflect today on how to address these challenges – to look forward and offer a perspective of where Europe could go.

In particular, I would like to develop three propositions.

First, while the reasons for European unity have often been presented as deriving from past conflicts and past divisions, forward-looking motivations are in my view decisive.

The unique construction of Europe – with strong local identities and large, integrated markets – is a source of great strength in the new, globalised world we face. It allows Europeans to plant deep roots and build strong communities. At the same time, we can fully benefit from economies of scale and the free flow of trade and investment.

For this reason, European integration is profoundly in the interests of all Member States and deeply connected to their future prosperity.

Second, for Europe to realise fully its future potential, it needs the right rules and the right institutions.

Europe requires a solid form of governance to ensure that the actions of individual countries are oriented towards the common good. Our current arrangements have not yet fully met this standard. They are now being improved. It is a continuous process which will call for Treaty changes if necessary.

As this process will take time, we need to start planning today for the Europe of tomorrow and the Europe of the day after tomorrow.

Third, the underpinning of a more integrated Europe is the emergence of a true European public debate.

As one would say in German, die Schaffung einer europäischen Öffentlichkeit.

Europeans today are highly interconnected via economic and social linkages. Yet our fragmented national public discourse does not necessarily permit citizens to understand fully these connections.

A true European public debate would help us deepen our interest in each other, bridge our linguistic differences and care more about what is happening across our borders.

These are the three main themes on which I will focus tonight.

But before I talk about the Europe of the future, I would like to talk about the Europe of today. To reflect on the relationship between member countries and Europe. And to touch on the challenges we collectively face in tackling the crisis.

1. Europe and Germany

Building deeper union between France and Germany in the service of Europe has been an important theme of my own working life. In this time, I have been profoundly influenced by the German commitment to a stability culture.

In the 1980s, I was seen in my own country as the strongest advocate of the ‘franc fort’ policy. This policy was designed to be part of the modernisation of the French economy through a “competitive disinflation” policy.

In the 1990s, I worked side-by-side with Hans Tietmeyer and Horst Köhler to contribute to the foundations of the euro in the Maastricht Treaty. This work was to ensure that, among other things, the European Central Bank (ECB) would be based on the principles of independence and the pursuit of price stability.

Then in 2003, I had the honour of moving to Frankfurt to become President of this institution.

It was a great personal satisfaction to join an institution that embodied my deep-seated beliefs in central bank independence, price stability and economic discipline.

Over this period I have developed a strong admiration for Germany and its people, and also for the way that Germany conducts its economic policies.

The German economy has often been thought of as the engine of the European economy. But less than 10 years ago, Germany was seen by some observers as the “sick man of Europe”.

Let me cite some books and newspaper articles from that time:

“Can Germany be saved?”, asked one of this country’s most well-known economists in 2003, noting that “Germany provides something of a case study of what not to do in designing a prosperous future”.

“How the mighty are fallen”, said a major international magazine also in 2003, well representing the mainstream economic analysis. "After the German economy was seen as an exemplary model of successful capitalism for decades,” the magazine went on, “ today it is Germany that economists point to with a mixture of contempt and alarm.”

“Vom Meister zum Mittelmaß”, wrote a major German newspaper in 2005, speaking of “absteigende Staaten wie Deutschland, die in ihrer Bedeutung schrumpften und ihren Haushalt nicht in den Griff bekämen. ”

Thankfully, these gloomy forecasts proved mistaken, and today, Germany is in the lead in rebounding from the crisis.

Since the trough of mid-2009, German real GDP has grown by 6.9% compared with the euro area as a whole by 3.8%. Employment in Germany has increased by 2.1%. Exports have grown by 25.6%. This performance is no accident. Neither is it based on cyclical, unsustainable factors. It is the result of sound fiscal policies, permanent attention to unit labour costs, and bold reforms that have been rigorously implemented over a prolonged period. And it sets an example that is very important for the current situation.

First, it demonstrates how sound policies can lead to prosperity within economic and monetary union.

By encouraging industries to embrace the opportunities of globalisation. By maintaining technological excellence. By prioritising cost and price competitiveness. And by ensuring flexibility in the labour market.

Second, it proves that it is possible to regain competitiveness within monetary union.

Germany after the post-unification boom had a very serious competitiveness problem itself. It took a sustained effort to become competitive again.

This gives encouragement to euro area countries that have lost competitiveness and now must regain it. It also underscores the fact that the adjustment effort must begin immediately.

But there is also a third lesson from the German example.

Would the German recovery have been possible without the euro and Germany being in the euro area? Without Germany benefiting from a vast single market of the size of the United States with a highly stable currency?

The German recovery has taken place in the context of the best inflation record achieved by a major central bank for over 50 years. The ECB has delivered an average rate of inflation of 2.0% since beginning operations in 1999. In Germany it is even lower with an average yearly inflation rate of 1.57%.

Such a low rate of inflation over a comparable time period is actually the lowest in Germany for over 50 years. Moreover, expectations of future inflation remain firmly anchored in line with our definition of price stability.

Financial markets and euro area citizens expect the ECB to deliver on its mandate. The German public can rely on our steadfast commitment to do so.

The euro has extended the zone of monetary stability to Germany’s main trading partners in the euro area. As more than 40% of Germany’s exports go to other euro area countries, this is very important for German prosperity. The stability of the euro has also helped German companies remain competitive vis-à-vis the rest of the world.

2. Europe and the crisis

Let me now turn directly to our current challenges. As you are all well aware, we continue to face the most serious economic and financial crisis since World War II. Tackling the crisis has required unprecedented action from public authorities to maintain economic and financial stability.

Inevitably this has produced diverging views. This is not surprising. The euro area is responding to events of historical importance and it naturally takes time to forge consensus on the right way ahead.

But it is very important that people do not misconstrue these debates. They are about policies, not about principles, because in the euro area our principles do not change.

Our principles are the foundations on which we rest. Stability. Responsibility. Independence.

But our policies must adapt. No two crises are the same. It is precisely because we want to defend and reinforce the principles we cherish, that we have to shape our policies appropriately.

I am fully aware that in this country people have genuine concerns about the single currency. They seek assurance that it remains a community of stability. That it is founded on rules and responsibilities. And that the rules are respected and the responsibilities are taken seriously.

I would like to use this occasion to explain the way the Governing Council of the ECB is deciding on monetary policy.

Our standard measure for fulfilling our mandate of maintaining price stability – avoiding both inflation and deflation – is interest rate policy. But effective interest rate policy requires that our policy decisions are transmitted to the real economy. If that is not the case, our monetary policy cannot achieve its objective.

In this transmission, both banks and financial markets play an important role. They are crucial for the financing of the real economy – of firms and households. Yet the crisis has damaged banks and at times severely disrupted the functioning of financial markets.

Addressing these problems needed to be done through non-standard measures. The ECB has decided such measures, for monetary policy reasons, since the very start of the global crisis. It has been offering liquidity to financial institutions at a fixed rate and with full allotment. It has also provided this liquidity over an extended period of time, up to 12 months, so that the euro area banking sector, Germany’s banks included, could continue to be as correct as possible a vehicle for the transmission of our monetary policy.

With additional liquidity demanded by the euro area banks, our balance sheet has expanded during the crisis. But we have been prudent. Our balance sheet has expanded by about 80% since the beginning of the crisis. Only for the sake of comparison the balance sheet of the Federal Reserve increased by about 230%, that of the Bank of England by 205%, and that of the Swiss National Bank by 235%. The crisis hit all of the economies concerned, but you can see that all our non-standard policies have been measured.

Of all our non-standard measures, the policy of full liquidity allotment at fixed rates has been the most important one in my view. Yet it is the bond market interventions that have received the greatest attention, and the most scrutiny.

But just as our measures of enhanced credit support have been necessary to ensure that banks continue to extend credit to the real economy, our bond market interventions have been necessary to help foster a more appropriate transmission of our policies to the real economy. The government bond markets are crucial for our monetary policy transmission. They largely determine the prices of loans and mortgages and thus affect, indirectly, the transmission of monetary policy to all firms and households.

The ECB’s government bond market interventions are not inflationary. Unlike the bond purchase programmes of other major central banks our aim is not to inject additional liquidity. We actually absorb all liquidity injected by these purchases on a regular basis – euro for euro, week by week.

There is no fuelling of money growth in the euro area. M3 growth is less than 3% currently and inflation expectations have remained firmly anchored by all standards.

So let me emphasise this point. It is very important to understand that all the ECB’s policy decisions during the crisis have been made fully in line with our mandate to maintain price stability.

They have been taken in full independence and we have established a solid track record for our independent decisions. Both inflation and inflation expectations in the euro area demonstrate the value of independent deeds, not just words.

Last week in Frankfurt, at the occasion of my official farewell as President of the ECB, Prime Minster Juncker, the longest-serving prime minister in Europe and chair of the Eurogroup, said that discussions of government pressure on the ECB lacked any basis in fact, that such pressure would have been completely futile and that the ECB always acts completely independently.

3. Europe and the future

I have talked about where Europe has come from. Let me turn now to where Europe is going.

When people seek a justification for European integration, there is a tendency to look backwards.

European integration has banished the spectre of war from our continent, is always stressed. European integration has delivered the longest period of peace and prosperity in European history.

This perspective is entirely correct. But it is also incomplete.

There are many more reasons for striving towards “ever closer union” in Europe today than there were in 1945. And these are entirely forward-looking.

65 years ago the distribution of global GDP was such that Europe had only one role model for its single market: the United States of America.

Today, Europe is faced with a new global economy, reconfigured by globalisation and by the emerging economies of Asia and Latin America.

It is a world where economies of scale and networks of innovation matter more than ever. By 2016 – that is, very soon – we can expect the euro area in terms of purchasing power parity to be below the GDP of China and over and above the GDP of India. Together, these two countries would represent around twice the GDP of the euro area.

Over a longer horizon, the entire GDP of the G7 countries will be dwarfed by the rapid development of the systemic emerging economies.

Europe has to cope with a new geo-political landscape very profoundly reshaped by these emerging economies.

And Europe is also faced with new global challenges, such as climate change and migration, where effective solutions are possible only at the European and international levels.

In this new global constellation, European integration – both economic and political – is central to achieving prosperity and influence. For an outward-looking, export-oriented country like Germany, this is profoundly in its interests.

The challenge is to set the correct path for European integration. Getting this right is essential to realise fully our continent’s tremendous potential. Let me therefore lay out a vision for the Europe of tomorrow.

The Europe of tomorrow

The creation of Europe’s economic and monetary union is unique in the history of sovereign states. The euro area constitutes a “society of states” of a completely new type.

Like individuals in a society, euro area countries are both independent and interdependent. They can affect each other both positively and negatively.

Good governance requires that both individual Member States and the institutions of the EU fulfil their responsibilities.

First and foremost, every country in the euro area needs to keep its own house in order.

This means responsible economic policies on behalf of governments and rigorous mutual surveillance of those policies by the Commission and Member States – going beyond the indispensable surveillance of fiscal policies to encompass all aspects of the economy.

In a society, the institutions of law enforcement can ultimately compel a citizen to abide by the rules. In the euro area, our framework based on surveillance and sanctions depends on the willingness of offending states to comply.

I am aware that many observers wonder what can be done if a Member State simply cannot deliver on its promises.

That is why, when I had the deep honour of receiving the Karlspreis, I suggested a new approach to the policing of economic governance.

For countries that lose market access, the current approach of providing aid against strong conditionality is justified. Countries deserve an opportunity to put the situation right themselves and to restore stability.

But as I suggested in Aachen, this approach should have clearly defined limits. A second stage should be envisaged for a country that persistently fails to meet its programme targets.

Under this second stage, euro area authorities would gain a much deeper and more authoritative role in the formulation of that country’s economic policies.

This would move us away from the present concept where all decisions remain in the hands of the country concerned. Instead, it would be not only possible, but in some cases compulsory, for the European authorities to take direct decisions.

Implementing this idea of the second stage would evidently require a Treaty change. It would also imply a new concept of sovereignty. This is necessary given the complex interdependence that exists between euro area countries. And it is ultimately in the interests of all citizens of the euro area.

In my view, it was important to launch such reflections as soon as possible. I am very happy that the European Council, at its meeting yesterday in Brussels, has indicated in its conclusions: “The European Council notes the intention of the Heads of State or Government of the euro area to reflect on further strengthening of economic convergence within the euro area, on improving fiscal discipline and deepening economic union, including exploring the possibility of limited Treaty changes.”

The Europe of the day after tomorrow

Let me now look even further into the future. A vision that can stabilise expectations needs to address not just tomorrow, but also the day after tomorrow. And as it takes time to implement such a vision, we must start thinking about it today.

It is my firm conviction that the Europe of the day after tomorrow will be of an original type – a new type of institutional framework.

In Aachen, on a personal basis, I began to reflect on some elements of this new possible framework.

I asked the question: with a single market, a single currency and a single central bank, would it be too bold to envisage a ministry of finance of the Union?

This European finance ministry would, first, oversee the surveillance of both fiscal policies and competitiveness policies, and when necessary, have responsibility for imposing the “second stage” I just described.

Second, the ministry would perform the typical responsibilities of the executive branches regarding the supervision and regulation of the EU financial sector.

And third, the ministry would represent the euro area in international financial institutions.

Since my Karlspreis address, it seems to me that the case for such an approach has strengthened.

I now hear leaders calling for a Treaty change to create stronger economic governance at the EU level. I hear euro area citizens calling for better supervision of the financial sector. And I know that our partners in the G20 look to Europe as a whole for solutions, not to individual Member States.

Increasingly, it seems that it is not too bold to consider a European finance ministry, but rather too bold not to consider creating such an institution.

This finance ministry would be only one element of the European future institutional framework. Exactly how these new institutions would eventually evolve one cannot say. As Jean Monnet once wrote: « Personne ne peut encore dire aujourd’hui la forme qu’aura l’Europe que nous vivrons demain, car le changement qui naîtra du changement est imprévisible ». [1]

We have several federal or confederal institutional frameworks in today’s world. To name only a few, the United States of America, the Federal Republic of Germany and the Swiss Confederation. The European Union is unique in its past history, in its present nature, in its future ambition. It will have to invent its own concept.

But one could imagine that in the future European institutional framework, the Council might evolve into the Senate of the Union, the European Parliament into the lower house, the Commission into the executive and the European Court of Justice into the judiciary – each time for the part of sovereignty that is shared.

And I have no doubt, taking into account the long and proud history of the European countries, that “subsidiarity” will play a major role in the future Europe – very significantly more than in the present models of federation.

As I said, these are personal remarks of a European citizen. The future of Europe is in the hands of its democracies, in the hands of the people of Europe. Our fellow citizens will decide. They are the masters.

In any case, whatever the future institutions of Europe will be, an essential element would be the emergence of a truly pan European public debate. As Europeans we connect deeply with our nations, traditions and histories. These are Europe’s roots. But we also need to extend our branches more widely.

To do this, the Euro area needs media, in the broadest sense of that word, that allow citizens to take a deeper interest each other. Media that provide regular information on events beyond national borders. Media that permit citizens to debate and exchange. And media that are not constrained by language barriers. All we need is a pan European public debate, a gemeinsamer öffentlicher Raum, a débat publique pan-Européen that allows Europeans to appreciate the wider community of which they are part – a community where their interests are increasingly shared and their lives more interdependent than ever before.

***

Let me draw to a close.

Twenty years ago, in 1991, my friend Hans Tietmeyer, the former President of the Bundesbank, said that “monetary union is not just a technical matter. It is in itself, to some extent, a political union”.

This condition creates mutual responsibilities.

We see that a challenge in one country can become a challenge for the euro area as a whole. Addressing it requires strong responses from all Member States, including Germany, and from EU institutions.

The global crisis has called into question the overall economic and financial strategy of major advanced economies. All have weaknesses in their economic systems. Not surprisingly, the main weakness for Europe was the nature of its institutional framework – in particular, that its economic and fiscal governance was not commensurate with the interconnectedness of economies sharing a single market and a single currency.

The question is how to confront those obstacles. We should not look back. We must look forward – to the opportunities of Europe for our collective betterment; and to the potential for every country to be stronger and more prosperous in a well-functioning union.

As far as the ECB is concerned, its Governing Council will continue to anchor solidly price stability and confidence in Europe – stability and confidence for 17 countries and 332 million fellow citizens who have decided to unite closely with a single market and a single currency. As Konrad Adenauer said in Aachen 57 years ago: “Gerade wird man die Mahnung verstehen, dass Europa uns heute Schicksalsgemeinschaft ist. Dieses Schicksal zu gestalten ist uns übergeben”. “Above all, people will understand the call: that Europe, for us today, is a community with a common destiny. It’s up to us to shape that destiny”.

Thank you for your attention.

Source: ECB: Tomorrow and the day after tomorrow: A Vision for Europe

Vatican calls for global authority on economy

The Vatican called on Monday for the establishment of a "global public authority" and a "central world bank" to rule over financial institutions that have become outdated and often ineffective in dealing fairly with crises.

The document from the Vatican's Justice and Peace department should please the "Occupy Wall Street" demonstrators and similar movements around the world who have protested against the economic downturn.

"Towards Reforming the International Financial and Monetary Systems in the Context of a Global Public Authority," was at times very specific, calling, for example, for taxation measures on financial transactions.

"The economic and financial crisis which the world is going through calls everyone, individuals and peoples, to examine in depth the principles and the cultural and moral values at the basis of social coexistence," it said.

It condemned what it called "the idolatry of the market" as well as a "neo-liberal thinking" that it said looked exclusively at technical solutions to economic problems.

"In fact, the crisis has revealed behaviours like selfishness, collective greed and hoarding of goods on a great scale," it said, adding that world economics needed an "ethic of solidarity" among rich and poor nations.

"If no solutions are found to the various forms of injustice, the negative effects that will follow on the social, political and economic level will be destined to create a climate of growing hostility and even violence, and ultimately undermine the very foundations of democratic institutions, even the ones considered most solid," it said.

It called for the establishment of "a supranational authority" with worldwide scope and "universal jurisdiction" to guide economic policies and decisions.

Such an authority should start with the United Nations as its reference point but later become independent and be endowed with the power to see to it that developed countries were not allowed to wield "excessive power over the weaker countries".

Asked at a news conference if the document could become a manifesto for the movement of the "indignant ones", who have criticised global economic policies, Cardinal Peter Turkson, head of the Vatican's Justice and Peace department, said:

"The people on Wall Street need to sit down and go through a process of discernment and see whether their role managing the finances of the world is actually serving the interests of humanity and the common good."

"We are calling for all these bodies and organisations to sit down and do a little bit of re-thinking."

EFFECTIVE STRUCTURES

In a section explaining why the Vatican felt the reform of the global economy was necessary, the document said:

"In economic and financial matters, the most significant difficulties come from the lack of an effective set of structures that can guarantee, in addition to a system of governance, a system of government for the economy and international finance."

It said the International Monetary Fund (IMF) no longer had the power or ability to stabilise world finance by regulating overall money supply and it was no longer able to watch "over the amount of credit risk taken on by the system".

The world needed a "minimum shared body of rules to manage the global financial market" and "some form of global monetary management".

"In fact, one can see an emerging requirement for a body that will carry out the functions of a kind of 'central world bank' that regulates the flow and system of monetary exchanges similar to the national central banks," it said.

The document acknowledged that such change would take years to put into place and was bound to encounter resistance.

"Of course, this transformation will be made at the cost of a gradual, balanced transfer of a part of each nation's powers to a world authority and to regional authorities, but this is necessary at a time when the dynamism of human society and the economy and the progress of technology are transcending borders, which are in fact already very eroded in a globalised world."

Continue reading - Reuters - Vatican calls for global authority on economy

In response to the Vatican calls for global authority on economy - Truth & Charity by Thomas E. Woods Jr.

Pope Calls For New Global Central Bank

The document from the Vatican's Justice and Peace department should please the "Occupy Wall Street" demonstrators and similar movements around the world who have protested against the economic downturn.

"Towards Reforming the International Financial and Monetary Systems in the Context of a Global Public Authority," was at times very specific, calling, for example, for taxation measures on financial transactions.

"The economic and financial crisis which the world is going through calls everyone, individuals and peoples, to examine in depth the principles and the cultural and moral values at the basis of social coexistence," it said.

It condemned what it called "the idolatry of the market" as well as a "neo-liberal thinking" that it said looked exclusively at technical solutions to economic problems.

"In fact, the crisis has revealed behaviours like selfishness, collective greed and hoarding of goods on a great scale," it said, adding that world economics needed an "ethic of solidarity" among rich and poor nations.

"If no solutions are found to the various forms of injustice, the negative effects that will follow on the social, political and economic level will be destined to create a climate of growing hostility and even violence, and ultimately undermine the very foundations of democratic institutions, even the ones considered most solid," it said.

It called for the establishment of "a supranational authority" with worldwide scope and "universal jurisdiction" to guide economic policies and decisions.

Such an authority should start with the United Nations as its reference point but later become independent and be endowed with the power to see to it that developed countries were not allowed to wield "excessive power over the weaker countries".

Asked at a news conference if the document could become a manifesto for the movement of the "indignant ones", who have criticised global economic policies, Cardinal Peter Turkson, head of the Vatican's Justice and Peace department, said:

"The people on Wall Street need to sit down and go through a process of discernment and see whether their role managing the finances of the world is actually serving the interests of humanity and the common good."

"We are calling for all these bodies and organisations to sit down and do a little bit of re-thinking."

EFFECTIVE STRUCTURES

In a section explaining why the Vatican felt the reform of the global economy was necessary, the document said:

"In economic and financial matters, the most significant difficulties come from the lack of an effective set of structures that can guarantee, in addition to a system of governance, a system of government for the economy and international finance."

It said the International Monetary Fund (IMF) no longer had the power or ability to stabilise world finance by regulating overall money supply and it was no longer able to watch "over the amount of credit risk taken on by the system".

The world needed a "minimum shared body of rules to manage the global financial market" and "some form of global monetary management".

"In fact, one can see an emerging requirement for a body that will carry out the functions of a kind of 'central world bank' that regulates the flow and system of monetary exchanges similar to the national central banks," it said.

The document acknowledged that such change would take years to put into place and was bound to encounter resistance.

"Of course, this transformation will be made at the cost of a gradual, balanced transfer of a part of each nation's powers to a world authority and to regional authorities, but this is necessary at a time when the dynamism of human society and the economy and the progress of technology are transcending borders, which are in fact already very eroded in a globalised world."

Continue reading - Reuters - Vatican calls for global authority on economy

In response to the Vatican calls for global authority on economy - Truth & Charity by Thomas E. Woods Jr.

Pope Calls For New Global Central Bank

Monday, October 24, 2011

Singularity Summit 2011 – A State of the Future

New York City was host to geeks from all walks of life this past weekend, as scientists, engineers, futurists, and other forward-thinkers converged for Singularity Summit 2011. It was 2 days of talks that touched on all aspects of the future, from cutting edge research in regenerative medicine and artificial intelligence to the coming disruption in traditional economics and even religious faith. It was fast-paced and dense at times, but also inspirational and stimulating.

Ray Kurzweil – From Eliza to Watson to Passing the Turing Test

Ray Kurzweil was the opening speaker to kick off Singularity Summit 2011 and he talked about his latest book project on building an artificial mind. He dropped some tidbits of what to expect in the book, including his assertion that translating the human neocortex into lines of code should only be about 1 million lines. Sure, that’s quite a bit of code, but not an impossible task. He went further to say that in terms of RAM, this should translate into approximately 25 megabytes when accounting for the redundancy of connections in the human brain. Of course, this is a bold prediction, but that’s what Kurzweil is known for. And not surprisingly, not everyone agrees with the claims he makes. Kurzweil spent the better part of his talk addressing a recent piece in Technology Review by Microsoft co-founder Paul Allen entitled “The Singularity Isn’t Near”. The article is a direct rebuttal of Kurzweil’s predictions (and his book “The Singularity is Near”). Kurzweil’s main counterpoint to Allen’s article is that Allen spends his time disputing Kurzweil’s article (The Law of Accelerating Returns) from 2001, admitting that he hasn’t read the much more detailed and comprehensive book “The Singularity is Near” that Kurzweil published in 2005. While it seems that Kurzweil is open to criticisms of his ideas, he was clearly incredulous that someone would attempt to discredit them without having actually sifted through the details.

Ray Kurzweil: "From Eliza to Watson to Passing the Turing Test"

Stephen Wolfram – Computation and the Future of Mankind

Dr. Stephen Wolfram presented on his work dealing with what he calls “the computational universe.” Of course, one cannot hear Wolfram speak without hearing about his discovery of “Rule 30”, an epiphany leading to his book “A New Kind of Science” and the computational search engine Wolfram Alpha. Wolfram is keen on his idea that mining the computational universe will inevitably lead to the sort of paradigm shift that the singularity represents. In speaking about himself, Wolfram generated some chuckles from the audience when he said that he is driven to deliver the future rather than just talk about it. This is something that other speakers also touched on, the need for more people to get involved in working on future technologies rather than just thinking and talking about them. We would all do well to follow Wolfram’s example!

Stephen Wolfram: "Computation and the Future of Mankind"

IBM’s Watson: Research, Commercialization, Application

I’ve lumped the last 3 talks of the summit into this section since they all dealt with IBM’s Watson supercomputer from different angles. First, David Ferrucci, lead developer of Watson, talked about what it was like to work on the project. He gave some specifics on Watson that were mind-boggling: 2,880 cores, 15 terabytes of RAM, and 80kW of power! To compete against human brains that run on a tuna fish sandwich and a glass of water. We might have the edge on energy efficiency so far, but it’s noly a matter of time. Ferrucci also talked about the separate development team that focused solely on Watson’s “pun detector” for Jeopardy! so that it would understand a clue about a holy city referring to St. Paul, MN and not just the Vatican. Next, Dan Cerutti, general manager of IBM’s Watson commercialization group, talked about the next potential fields where we might see Watson working. After all, it wasn’t just built to play Jeopardy! The most likely applications are in the finance world (see Wissner-Gross’s presentation) and the healthcare field. While IBM isn’t looking to replace human doctors just yet, there is a place for Watson alongside clinicians, helping to track and diagnose patients, and helping to reduce costs and mistakes along the way. Other potential applications include the legal world, with the loads of text and notes that need to be analyzed as well as education and customer service. The final talk of the summit was Ken Jennings, who talked about what it was like to play against Watson…and lose! This might have been the funniest of all presentations and Jennings really had a great stage presence. It was light-hearted and very informative as to the behind-the-scenes workings of Jeopardy! Jennings did, however, take the time to address some topics related to the singularity. He voiced some concern that our over-dependence on technology was making us dumber and cited some studies that had actually shown atrophy of the hippocampus in response to less use and conversely, it’s growth when stimulated, as in the taxi drivers of London, who are tasked with the daunting job of navigating the city’s busy streets. So a bit of a serious and cautionary tone but overall, a great presentation. And one that got plenty of positive responses from the audience!

David Ferrucci: "IBM’s Watson: Research, Commercialization, Application"

David Ferrucci, ,Dan Cerutti and Ken Jennings on IBM's Watson

James McLurkin – The Future of Robotics is Swarms: Why a Thousand Robots Are Better Than One

Dr. James McLurkin, assistant professor of computer science at Rice University presented his work on swarm robotics, which is using a group of communicating robots rather than a single robot to address a problem. McLurkin’s work specifically focuses on development of distributed algorithms that can be used to affect behavior among such a group. The idea of swarm robotics comes from nature, where we witness insects such as ants and bees that can communicate and coordinate their efforts to accomplish a task that no individual could ever do alone. The emergent properties that arise from a coordinated group come from the transformative power of increasing population sizes. Thus, you can do things with a thousand robots that you can’t do with 10 and you can do things with a million robots that you can’t do with 10,000 and so. Soon after McLurkin described his research, he delighted the audience by doing a live demonstration using several of his robots. He would assign a task to the robots – find a treasure or line up in increasing numerical order after being assigned a number – and then the robots would communicate with each other to accomplish their task. To make the demonstration even more engaging, the robots would play a simple tune as they went about their work. However, McLurkin didn’t stop there. He showed videos that his research team put together showing some potential real-life applications of swarm robots (check out one of them below). For example, a large group of miniature robots programmed with the blueprint of a collapsed building could quickly search the rubble for survivors. And to be most efficient at this task, some robots would be assigned to be “place-markers” so that once an area has been searched, the remaining robots will know not to waste time there and instead venture to the unexplored parts of the building. As McLurkin put it, these multi-robot systems will use their physical configuration as a primary data structure. McLurkin closed his talk on a slightly different note, describing his efforts to bring these robots to K-12 classrooms in order to educate and inspire the next generation of scientists and engineers. And with Americans falling behind in math and science on the global stage, this kind of outreach is what’s needed to make science appealing and just downright fun!

MIT's James McLurkin: Swarm Robotics

James McLurkin: "The Future of Robotics is Swarms: Why a Thousand Robots Are Better Than One"

Jason Silva – The Undivided Mind: Science and Imagination

Jason Silva, a TV personality known as a host on Al Gore’s Current TV channel, gave a peppy presentation focusing on the need to package the idea and message behind the singularity in such a way that the general public will not only understand it, but also be excited by it. He showed a couple of video clips that featured a montage of fast-moving clips coupled with uplifting music and Silva narrating a philosophical outlook on what the future is shaping up to be. Check out one of those videos below. Jason summed up his talk with the quote “Articulate the future by utilizing a pop culture vernacular.” Basically, make the singularity sexy to get more people on board. It is too big a concept to be dominated by nerds!

The Beginning of Infinity - A Mashup of techno-optimism!

Jason Silva: "'The Undivided Mind' — Science and Imagination"

Scott Brown and Dileep George – From Planes to Brains: Building AI the Wright Way

Another presentation on artificial intelligence, this time from 2 guys with a new start-up taking a unique approach. Scott Brown and Dr. Dileep George, founders of Vicarious Systems, tag-teamed this presentation about the science, engineering, and business behind their company. Their approach is akin to what the Wright brothers did for flight in that although they took inspiration and insights from the way birds soared, they didn’t try to fly by using an airplane that had flapping wings. In the same manner, although AI development is based on a human brain, it doesn’t need to function in exactly the same manner. Instead Vicarious Systems seeks to exploit the underlying assumptions the brain uses to process information for building AI. George went on to explain how neuronal processes involved in keeping the cells alive, communicating with other neurons, and processing information are found in all levels of brain organization. However, the goal of AI development is to just tease out the information processing ability of neurons to replicate. The other abilities of the neurons are irrelevant. With a substantial amount of funding from some big names in Silicon Valley, it seems that the Vicarious approach to AI development is resonating with many people. Keep an eye on these guys!

Dileep George and Scott Brown: "From Planes to Brains: Building AI the Wright Way"

Eliezer Yudkowsky - Open Problems in Friendly Artificial Intelligence

Eliezer Yudkowsky, a research fellow at the Singularity Institute, gave a lively presentation about some issues that might be involved with creating an artificial intelligence (AI) that is fully capable of self-modification. He argues that just because we may eventually succeed in building this sort of AI (which he believes will happen) AND we are successful in making it a friendly AI (meaning it will not want to destroy our species), we simply can’t ensure that the subsequent AIs it produces will remain friendly. While it is a scary thought, Yudkowsky presented it more as a challenge to those who are working on developing this critical new technology. You can read more in-depth about Yudkowsky’s ideas in this online paper he authored.

Eliezer Yudkowsky: "Open Problems in Friendly Artificial Intelligence"

Alexander Wissner-Gross – Planetary-Scale Intelligence

Dr. Alexander Wissner-Gross, a research affiliate of the MIT Media Laboratory, presented on how we can predict where a AI with worldwide reach would come from. In his view, it would come from the finance and marketing industries. Wissner-Gross believes that since money is the great motivator and the finance and marketing industries are most concerned with predicting how to invest and how to sell to consumers, they have the greatest incentive to develop AI. Between these two industries however, Wissner-Gross believes that finance will reach this holy grail first, since that industry is flush with investment dollars and is currently very advanced technologically. And you don’t need to be a Wall Street financier to realize this. The speed at which financial information zooms around the planet, with high-speed computers running sophisticated software programs to analyze the markets and make instantaneous trades, is currently mind-boggling. So much so in fact, that regulatory bodies like the US Securities and Exchange Commission are playing catch-up to make sure that these investment firms are playing within the rules. Wissner-Gross says that the singularity will likely play out in a manner similar to what we’re seeing with the role of increasingly sophisticated programs in the finance world and we had better start paying attention.

Alexander Wissner-Gross: "Planetary Scale Intelligence"

Max Tegmark – The Future of Life: A Cosmic Perspective

Dr. Max Tegmark, professor of physics at MIT, gave an engaging talk on taking a more long-term viewpoint when thinking about the future. And he really means long-term, as in the billions of years our sun is estimated to continuing burning for and where exactly the universe may be heading. Sure, most of us are convinced that the Big Bang adequately explains the origins of the universe, but do we know where it’s heading? The Big Rip or the Big Snap as the universe continues to expand until reaching some limit like a rubber band being stretched out? The Big Chill where the cooling of the universe continues until life can no longer exist? And while on the topic of life in the universe, Tegmark asked the audience if they thought that life exists anywhere besides Earth. He explained that although the common answer is “probably, since there are so many galaxies and planets and stars, etc”, he doesn’t think it is. And here is where he made a startling point: based on the Drake equation, there is some probability of intelligent life occurring outside of our planet. However, there seems to be a strong limit in the ability of an intelligent life to colonize and make contact outside of their respective corner of the universe. So the question is…where is that limit? Is it before the point of evolution we have reached? Or is it after the point of evolution we have reached? In other words, is the most difficult step evolving from single-celled organisms to intelligent and sentient multicellular organisms? Or is it evolving from this intelligence level and surviving long enough to colonize the galaxy and then the universe? A very profound question and one that should inform our decisions on a global level. Perhaps we are the greatest threat to ourselves and our potential to move beyond the limits of this planet.

Max Tegmark: "The Future of Life: A Cosmic Perspective"

Christof Koch – Neurobiology and Mathematics of Consciousness